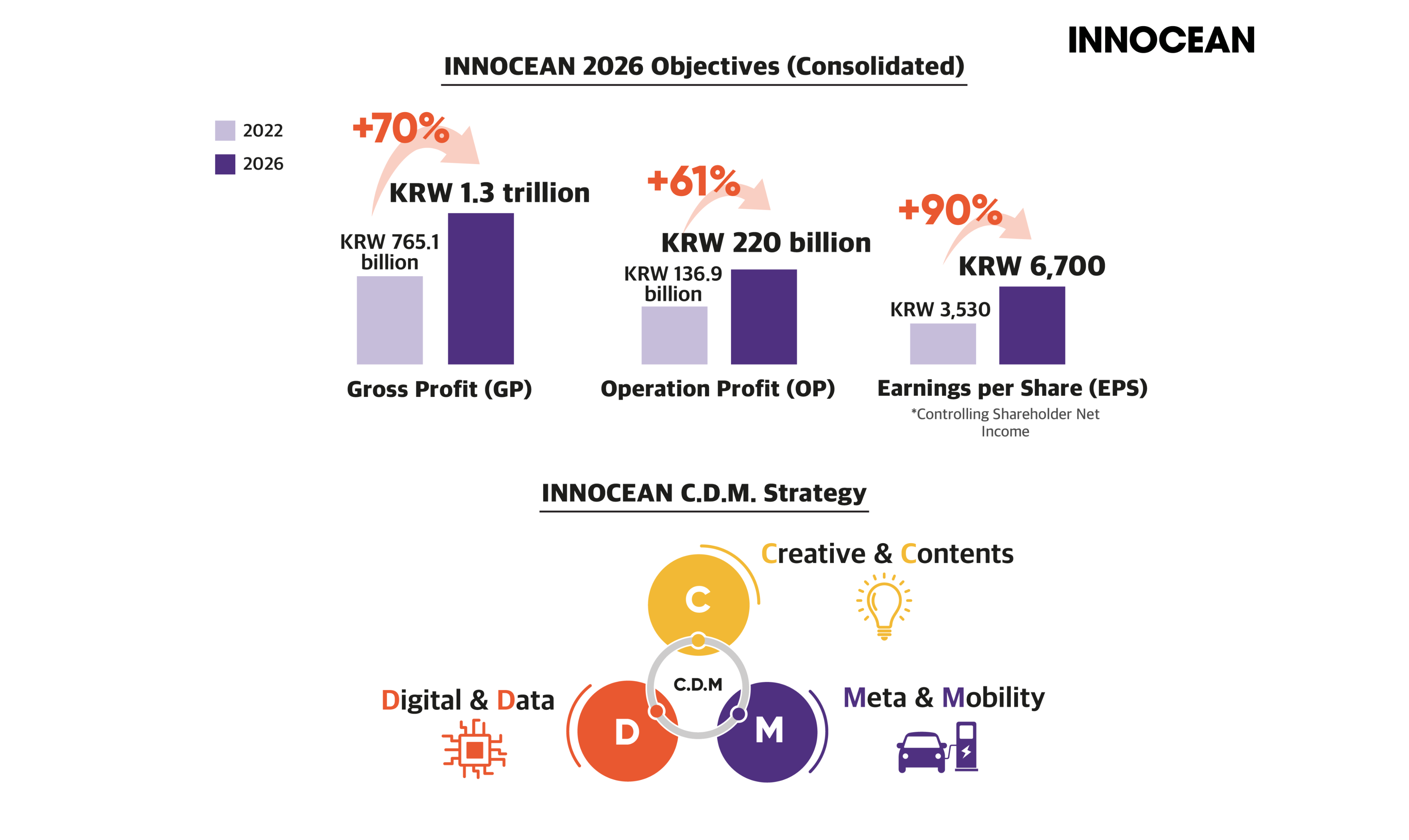

INNOCEAN hosted the “2023 INNOCEAN Analyst Day” to present its future growth direction, business objective and strategies. INNOCEAN emphasized that it will achieve gross profit of KRW 1.3 trillion (+70% compared to 2022%), sales profit of KRW 220 billion (+61%) and earnings per share of KRW 6,700 (+90%) by 2026.

To achieve these business objectives, INNOCEAN plans to further develop the 3 keywords “C.D.M.” (C – Creative & Contents, D – Digital & Data, M – Meta & Mobility) it announced last year.

First, for the C sector, the company explained the potential and anticipated effects of “STUDIO abit,” a joint venture established between INNOCEAN and the content creation studio IMAGINUS. INNOCEAN plans to create a variety of contents, including commercial contents and branded contents, with “STUDIO abit.” By continuously accumulating popular IPs and expanding commercial and marketing profits, INNOCEAN aims to develop STUDIO abit into a new key player in the content market.

Second, the key in the D sector is mergers and acquisitions (M&A). INNOCEAN aims to become a Pan-Europe “Data-Driven Agency” by strengthening its data marketing capability through aggressive M&As in Europe and by expanding its business portfolio.

Third, expanding the company’s EV value chain, which has the largest business potential, is the keyword for the M sector. This sector includes the transmission of content and advertising through mobility media and the development of INNOCEAN’s own platform capable of collecting/analyzing/reporting related data.

During the event, INNOCEAN also presented financial strategies to achieve its mid- to long-term growth objectives for 2026. The company announced plans to invest about KRW 500 billion in 3 major strategies: ▲domestic and overseas M&A and equity investments, ▲strengthening of existing business competitiveness, and ▲expanding the global network. It also announced of the implementation of “1:1 free issuing.” in order to increase company stock value.

Taken from: http://innocean.com/ww-en/news/263