When finance customers face market volatility, it’s natural for them to feel anxious. They’re grappling with the possible impact of the uncertainty on their funds. So for finance marketers like yourself, it’s not enough to simply keep calm and carry on — you need to adapt swiftly to your customers’ needs in a fast-changing environment.

Over the last 12 months, uncertainties in geopolitics and changes in inflation and interest rates have left people in APAC wanting to feel confident about their decisions. More than 70% of consumers want to feel they’ve done their due diligence, putting enough time into research to make the right decision.1 And finance customers are among them.

Finance marketers navigating volatile times can’t simply keep calm and carry on — AI-powered marketing is an imperative for them.

As a marketer, you’ll need to understand how customers’ search behavior is evolving with the volatility, and reach them wherever they are, at speed, with information that’ll help them make confident decisions. Simply put, AI-powered marketing is imperative.

Why AI-powered finance marketing is an imperative

Finance customers are no longer content with having the latest financial information at their fingertips; they’re raising the search bar. They want to make confident decisions amid uncertainty and this need is reshaping how they search in two ways.

One, they’re searching more. They’re casting their search nets broader to be thoroughly informed about widely fluctuating markets.

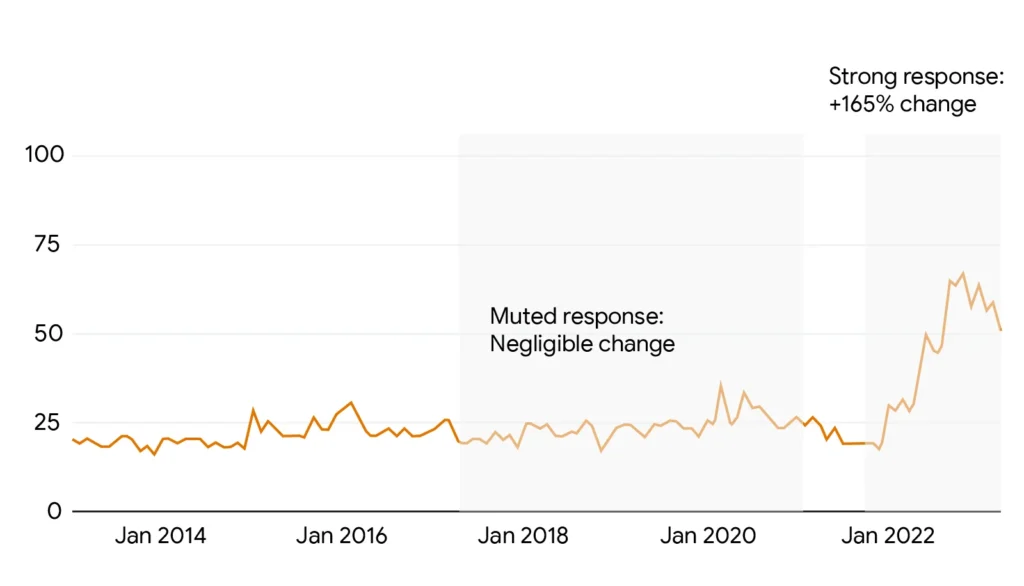

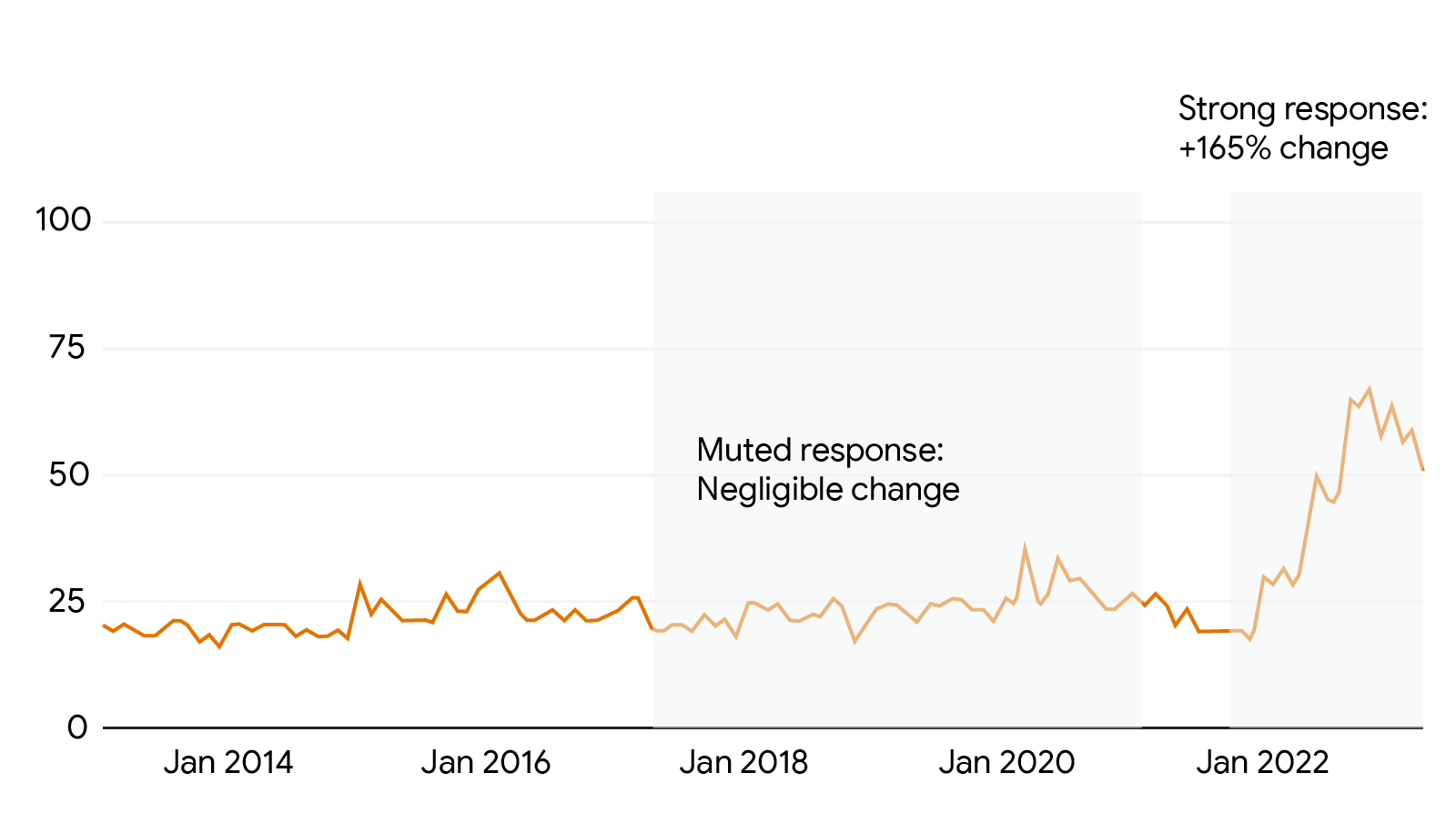

For instance, between 2022 and 2023, when interest rates were soaring,2 there was a 165% spike in search volume for the topic of “interest rates.”3 In contrast, search volumes for the same topic barely budged the last time interest rates rose between 2018 and 2019.

Search volume for interest rate in Singapore

Two, their searches are more specific. Consumers are using more detailed search phrases, such as “small car insurance” rather than the more generic “car insurance,” to find information that precisely addresses their circumstances and needs.

Their queries are also becoming more complex. Search phrases like “pet insurance that covers hip dysplasia” and “student credit cards with no foreign transaction fees” appeared for the first time in 2023.4

The shift toward more specific searches coincides with the declining share of the 100 most-searched finance terms. These terms made up 10% of all finance-related search volume in Southeast Asia in the second quarter of 2021. But that share dropped to 8% by 2023.5

With customers seeking out larger volumes of information that is highly specific, AI-powered ad solutions play a crucial role in letting you show up wherever customers are, and analyze and deliver information relevant to their fast-evolving needs. This, in turn, optimizes your finance marketing efforts toward conversion and purchase.

How AI-powered finance marketing drives confident purchase decisions

Here are three ways AI-powered ad solutions let you empower finance customers to make confident decisions:

1. By optimizing your customer reach

For customers to choose you every time, you need to reach them wherever they are on their purchase journey, and this is possible with Performance Max.

Not only does the AI-powered solution deliver your ad content across all Google Ads inventory, including Search, YouTube, Gmail, Display, and Discover via a single campaign, it also optimizes how your brand shows up for customers to drive incremental conversions.

Thailand’s Krungthai Card, for instance, paired its existing campaigns, including Search, with Performance Max, to reach prospective customers wherever they’re searching for a suitable credit card. The AI advertising solution, which delivered creative content customized to the various Google ad properties, resulted in a 42% boost in conversions on top of its existing campaigns.

2. By being hyper-relevant to searches

To provide relevant information about your financial product or service to customers at scale, it’s no exaggeration to say that you’ll need to analyze literally millions of data points to know what’s relevant. And this is a massive task that AI ad solutions like broad match can pull off with optimal results.

Supercharged by language upgrades and contextual signals like a user’s location, broad match is primed to understand users’ search intent — even if their search doesn’t contain keywords of similar meaning — and identify high-intent queries.

By applying broad match to your ad campaign, you can make it highly relevant to a wider audience and engage the users most likely to convert. That’s what Thailand’s KBank did to win more customers for its loan management products in a competitive market.

It experimented with switching from exact and phrase match to broad match, alongside the use of Smart Bidding. By focusing and optimizing its media spend on keywords that work best, it was able to capture 3X more leads and boost sales, while lowering its cost-per-acquisition by 11%.

3. By responding dynamically

Besides showing up with relevant information, your message should respond directly to customers’ ever-changing interests. Here’s where responsive search ads come in.

The solution, powered by Google AI, is able to dynamically alter an ad message to suit shifting customer needs. It does this by using the ad headlines and descriptions you provide to create different combinations that better match a range of customer queries.

It also applies testing and machine learning to swiftly identify which combinations perform best, and adapts the ad content accordingly to optimize your campaign’s performance.

Anxiety may be a common response to market volatility, but customers can overcome it when they’re empowered to make confident decisions. And finance marketers like you can play a critical role in this by using AI advertising solutions to deliver relevant, timely information to customers.

Contributor: Mallika Sriram, Product Marketing Manager